Fca Forms Smcr

The concept of money laundering is essential to be understood for those working in the monetary sector. It's a course of by which soiled cash is converted into clear money. The sources of the money in actual are legal and the cash is invested in a way that makes it appear like clear money and hide the identity of the legal part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the brand new customers or sustaining present prospects the obligation of adopting adequate measures lie on each one who is a part of the group. The identification of such factor to start with is easy to cope with as an alternative realizing and encountering such conditions later on in the transaction stage. The central bank in any country offers complete guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide enough security to the banks to discourage such conditions.

Please read these notes which are available on the FCA. We set out our expectations to help solo-regulated firms apply the SMCR.

Https Www Fca Org Uk Sites Default Files Form K User Guide Core Cf2 Pdf

The process for transferring from a SMF from an insurance firm to a banking firm.

Fca forms smcr. Today following a request from the FCA the Treasury has made a statutory instrument to delay from 9 December 2020 until 31 March 2021 the deadline for solo-regulated firms to have undertaken the first assessment of the fitness and propriety of their Certified Persons. Long Form A Solo-regulated firms including EEA and third country Application to perform controlled functions including senior management functions FCA Handbook Reference. If you are already registered we can also assist firms with your Variations of Permission andor Change of Control.

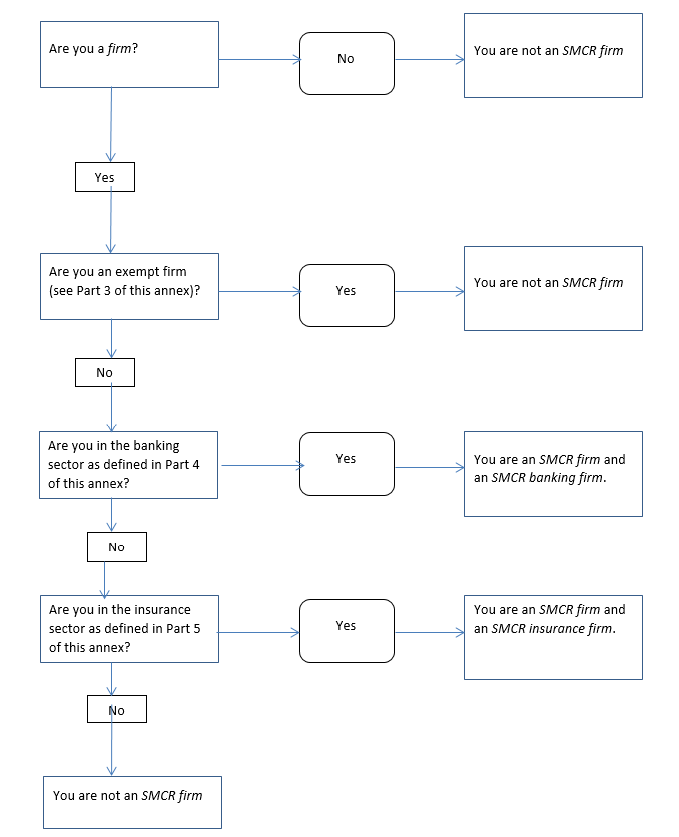

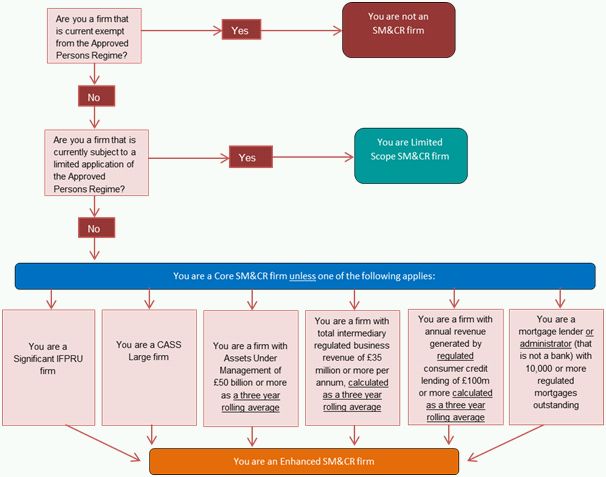

The FCAs proposed approach to converting approved individuals from the APR to the SMCR. The FCA may on a case-by-case basis require a limited scope SMCR firm or a core SMCR firm to comply with the requirements that apply to an enhanced scope SMCR firm if the FCA considers it appropriate to do so to advance one or more of its operational objectives under the Act. The SMCR will apply to all FCA solo-regulated firms authorised under Financial Services and Markets Act 2000 FSMA as well as EEA and third-country branches.

FCA policy statement PS1816 with final guidance on the duty of responsibility for insurers and FCA. The removal of gendered language from the SMCR. Importantly the FCA have clarified that firms must submit their Form K Conversion Notification by 2359 on 24 November 2019.

Senior Managers and Certification Regime SMCR and coronavirus Covid-19. Insurers are also in scope but we have provided a separate guide and Policy Statement PS for these firms. On 3 April the FCA published a statement alerting FCA solo-regulated firms of its expectations under the Senior Managers and Certification Regime SMCR during the continued COVID-19 situation.

Its purpose is to inform firms of their need to keep their governance arrangements under review and to make appropriate adjustments as circumstances change. Extending the SMCR to FCA firms feedback to CP1725 and CP1740 and near-final rules with accompanying Guide for FCA solo-regulated firms. From collation of required documents to completion of the form and finally in assisting you to field enquiries from your FCA case officer.

The opt-up will take effect three months from the date of this notification. The FCA this week has released additional guidance to solo-regulated firms submitting SMCR forms in respect of Senior Managers ahead of the implementation deadline of 9 December 2019. If a firm submits this form to opt-up that firm will be subject to the rules of the new SMCR classification three calendar months.

Scope SMCR firms can also use this form to notify the FCA that they agree to be subject to the rules for core SMCR firms set out in SYSC 23 Annex 1. Why regulations have changed. Form K now available.

Form K Conversion Notification Form FCA solo-regulated firms. The FCA and PRA consultation papers include proposals on rationalising and streamlining forms. We have also applied the SMCR to the FCA and published information about how weve done this.

The SMCR has applied to UK banks building societies credit unions branches of foreign banks operating in the UK and the largest investment firms regulated by the PRA and the FCA since 7 March 2016. Short Form A Solo-regulated firms including EEA and third country Page 1 Application number for FCA use only The FCA has produced notes which will assist both the applicant firm and the candidate in answering the questions in this form. See here for further guidance on Form K.

We recognise that firms directly affected by coronavirus will need to keep their governance arrangements under review and make appropriate changes as. Our expectations of solo-regulated firms. Implementing the extension of the SMCR to insurers Solvency II firms non-Directive firms NDFs and small run off firms.

This can also be used to submit updates to a previous Form K. Short Form A Solo-regulated firms including EEA and third country Application to perform controlled functions including senior management functions Chapter. Both the applicant and the candidate will be treated by the FCA as having taken these notes into consideration when completing this form.

We welcome the publication of the statutory instrument. FCA policy statement PS1814. Firms that are not authorised under FSMA for example Payment.

SUP 10C Annex 3D 9 December 2019. Enhanced firms and Core firms on an exceptions basis An application to convert the firms approved individuals from the Approved Persons regime to new functions under the SMCR.

Https Www Handbook Fca Org Uk Form Sup Sup 10c Ann 3d Solo Long Form A 20191209 Pdf

Https Fca Org Uk Sites Default Files Form K User Guide Enhanced Pdf

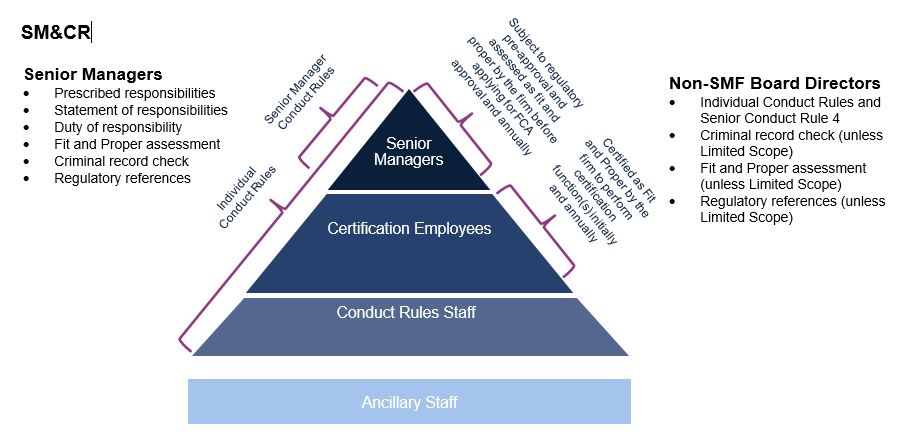

Overview Of The Senior Managers Certification Regime

Smcr The Five Things Everyone S Stuck On Ftadviser Com

Senior Managers Certification Regime Smcr December 2019

What Does The Fca Mean Ready Willing Organised Fca Authorisation Speci Fca Organization Financial Services

Latest News And Updated Guide The Extension Of The Sm Cr To Fca Regulated Firms Finance And Banking Uk

The Fca Have Released Cp17 25 Extending The Senior Managers And Certification Regime Fstp

Fca Updates Sm Cr Guidance Peer2peer Finance News

Fca Consults On Transition To Sm Cr

Overview Of The Senior Managers Certification Regime

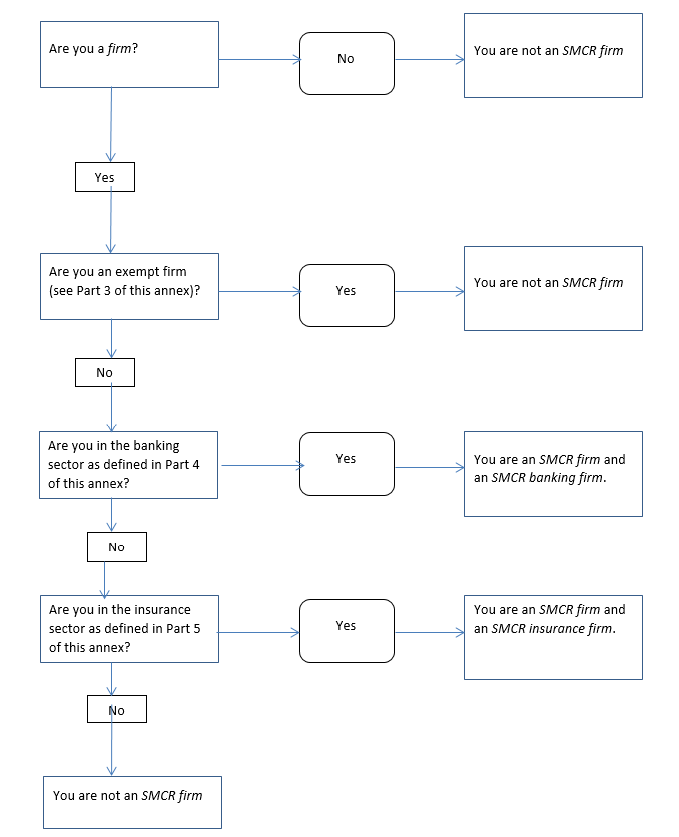

Sysc 23 Annex 1 Definition Of Smcr Firm And Different Types Of Smcr Firms Fca Handbook

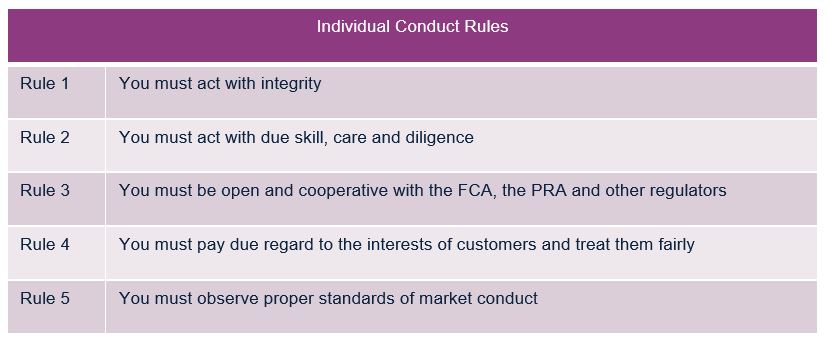

What Are The Fca Conduct Rules

The world of regulations can seem to be a bowl of alphabet soup at times. US money laundering rules aren't any exception. Now we have compiled a listing of the top ten money laundering acronyms and their definitions. TMP Risk is consulting firm centered on defending financial providers by reducing danger, fraud and losses. We have huge financial institution experience in operational and regulatory risk. We now have a strong background in program management, regulatory and operational threat in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many hostile consequences to the organization due to the risks it presents. It increases the chance of major dangers and the chance cost of the financial institution and in the end causes the bank to face losses.

Comments

Post a Comment